The rise of online travel agencies (OTAs) is one of the most dramatic examples of the digital transformation of business and society over the last 25 years.

In a relatively short space of time, OTAs – from giants such as Booking.com, Expedia and Trip.com to the estimated 400 smaller players – have captured an average of 40% of the total global travel market (hotels, airlines, packaged tours, rail and cruises), according to research by PATA.

OTAs have evolved into digital marketplaces that connect both B2B and B2C customers directly with a full range of travel products. In fact, OTAs can be viewed as a hybrid of an e-commerce platform and a travel agency.

Although OTAs have certainly taken market share from traditional travel agents, they have not replaced them. In many travel markets across the world, OTAs and traditional travel agencies co-exist because they perform different roles.

Many tourism businesses (hotel groups, tour operators, visitor attractions etc…) will use OTAs for a percentage of their distribution while using traditional travel agencies for specific segments – perhaps an older demographic or consumer groups who are less comfortable using technology.

Contents

The OTA market in North America

The United States is the largest travel market in the world, accounting for $2.1 trillion in 2019. In the same year, the number of international tourist arrivals to the U.S. reached nearly 80 million after being on the increase for more than a decade. The two OTA giants, Expedia and Booking Holdings, continue to dominate in the US,representing 92% of the OTA market, says Phocuswright, although US online travel agency bookings fell sharply by 59% during 2020 as a result of the global pandemic.

The OTA market in South America

Despegar, BestDay.com, and Price Travel are the main OTA players in South America. OTAs are top of the list for consumers looking for flights and accommodations in Argentina, and for accommodation in Mexico.

On the other hand, search engines are the number one channel to start searching for flights and accommodations in Brazil and for flights in Mexico, says a 2020 survey.

Although South America has been particularly hard hit by the global pandemic, one positive trend across the region’s travel market is the continued growth of online distribution.

Internet access is expanding significantly – Argentina boasts a 92% internet penetration rate, while Mexico’s mobile internet penetration jumped from 36% to 55% in 2019, second only to Uruguay in South America. As a result, South American online travel revenue rose in 2019.

The OTA market inEurope

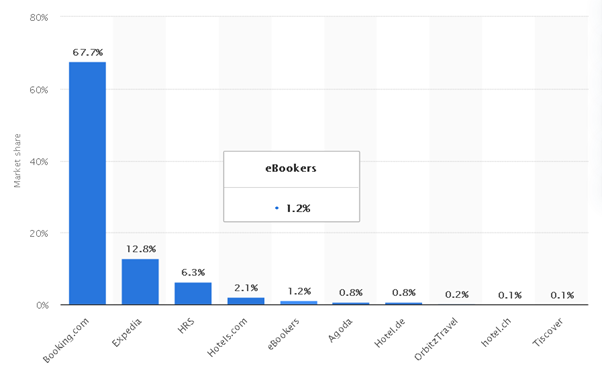

Chart 1: OTA market share in Europe in 2019

Booking.com is the biggest player in the European OTA market with a 67.7% share in 2019, according to Statista. Expedia and HRS had the second and third largest shares of the market, at 12.8% and 6.3% respectively.

Taking a look at individual countries, the UK’s online travel market is the largest in Europe, and the country’s online travel penetration is among the highest in the world, according to Phocuswright. Compared to Continental Europe, OTAs themselves play a smaller role in the UK market. In 2020, online supplier-direct booking share of the total market remained at 51%, while OTA share increased one percentage point to 18%.

In Spain, by comparison,OTAs accounted for29.9% of the country’s travel market, making it one of the most popular booking distribution channels in Europe. Spain is home to a number of successful OTAs, including B2B bedbank Hotelbeds, which has its headquarters in Palma de Mallorca, and eDreams and Altrapálo, both based in Barcelona.

The Best OTA market in APAC

At $44.7 billion, China had the world’s second-biggest OTA market in 2018, compared to the US at $77.1 billion, and its 27% growth compared to 2017 was more than four times that of the US, according to Phocuswright.

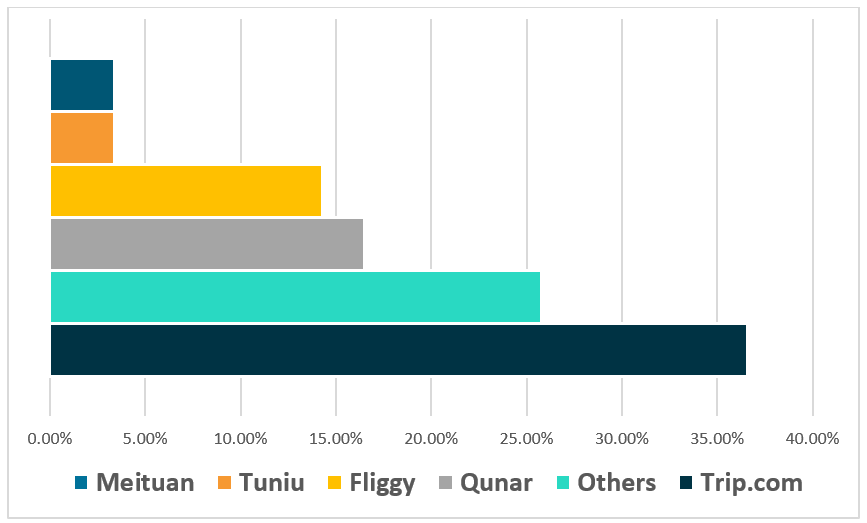

Trip.com ( formerly known as Ctrip) is the largest OTA in China with a 36.6% share of the online travel market. In next place comes Qunar (also owned by the Trip.com Group) with a 16.5% share. One of the key competitors to Trip.com’s dominance isFliggy, which is owned by Alibaba, the Chinese e-commerce giant often compared to Amazon in the west. The Chinese OTA market displays a more competitive range of challenger players when compared to the duopoly of Booking.com and Expedia that exists elsewhere.

Chart 2: Popular OTAs in China

Looking outside China to other east and southeast Asian countries, MakeMyTrip, Rakuten and Recruit are the leading OTAs in Japan and Traveloka is the dominant player in Indonesia.

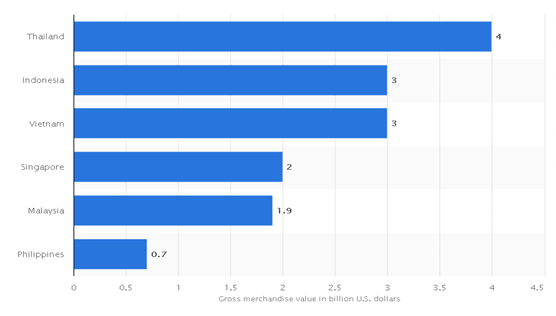

As measured by gross merchandise value, Thailand ($4b), Indonesia ($3b) and Vietnam ($3b) are the biggest online travel markets in the region outside China, according to data supplied by Statista.

Chart 3: APAC online travel market scale by country (2020)

In India, MakeMyTrip is the leading OTA. Excluding the four major international OTAs – Booking.com, Expedia, Airbnb and Agoda – that also operate successfully in the Indian online travel market, the sub-continent has a dynamic range of home-grown challenger OTAs, including Cleartrip, Yatra, and Via.com

What are the Top online travel agencies in the world?

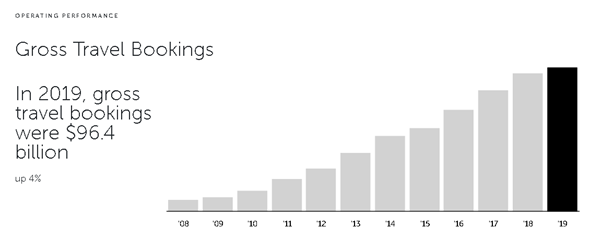

Booking Holdings (formally Priceline Group), the company that owns Booking.com, was the leading online travel agency worldwide in 2019. Its gross sales were $96.4 billion and EBITDA were at $5.9 billion, up 2% compared to the previous year.

Chart 4: Booking Holdings Gross Travel Bookings 2019

As previously mentioned, Booking Holdings and Expedia dominate the global OTA market, particularly in North America and Europe. They have succeeded in capturing maximum market share through a series of mergers and acquisitions making them essentially travel conglomerates. Here is a full list of the brands owned and operated by Expedia Group and Booking Holdings.

Chart 5: Brands owned by Expedia and Booking Holdings

| Expedia Group | Booking Holdings |

| Expedia.com Hotels.com Vrbo Egencia Travelocity trivago HomeAway Orbitz hotwire wotif ebookers cheaptickets CarRentals.com Classic Vacations traveldoo Silverrail Tripadvisor |

priceline.com agoda.com booking.com KAYAK Opentable.com rentalcars.com |

As standalone online businesses, based on their 2019 results, the top five OTAs in the world are:

- Booking.com ($15.07b)

- Expedia ($12.07b)

- Trip.com ($5.10b)

- Tripadvisor ($1.56b)

- Trivago ($0.84b)

However, in terms of revenue growth, the picture was different in 2019, with On The Beach leading the list with the biggest increase in revenue that year:

- On The Beach (+41%)

- Lastminute (+20%)

- Trip.com (+12.3%)

- eDreams Odigeo (+8.2%)

- Expedia (+7.5%)

Obviously, 2019 marks our final year of the ‘old normal’ before the COVID-19 pandemic changed everything. Still, with vaccine rollouts underway across the globe, it won’t be long before we are enjoying travel again, perhaps more than ever before! And OTAs will once again be playing their important roles in improving customer service and taking digital innovation forward.